Prepress

Marketers Struggling to Reinvent Themselves in Digital Age, Adobe Study Reveals

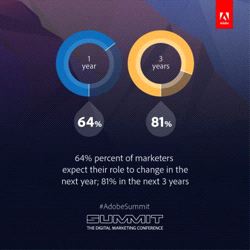

Tuesday 01. April 2014 - 64% of marketers expect their role to change in the next year; social marketers, data analysts and mobile marketers in high demand

Adobe Digital Marketing Summit While two in five (40%) marketers stated that they want to reinvent themselves, only 14% of those marketers actually know how to go about it, according to research released today from Adobe (NASDAQ: ADBE). The study, Digital Roadblock: Marketers Struggle to Reinvent Themselves, is based on a survey of more than 1,000 marketing professionals in the U.S. and exposes fresh insights into the attitudes and beliefs of marketers as they struggle to redefine their roles and expand their skills. The findings are being released today at Adobe’s 12th annual Digital Marketing Summit, a conference attracting over 5,000 marketing professionals.

Underscoring the rapid transformation of the marketing profession, 64% of marketers expect their role to change in the next year and 81% believe their role will change in the next three years. But the path to reinvention remains a challenge. Respondents cited lack of training in new marketing skills (30%) and organizational inability to adapt (30%) among the top obstacles to becoming the marketers they aspire to be.

Risk Aversion Holding Marketers Back

Asked to describe the ideal, successful marketer 12 months from now, 54% of marketers said they should take more risks, and 45% hope to take more risks themselves. On the topic of new technologies, marketers are generally playing it safe, with 65% saying they are more comfortable adopting new technologies once they become mainstream.

The findings also highlighted a gap between marketers in companies that spend more than 25% of their marketing budget on digital campaigns compared to those that spend less than 10% on digital. Marketers in high digital-spend companies are more likely to believe (82%) they need to reinvent themselves to succeed, versus low digital-spend companies (67%). Marketers from high-performing companies* are three times more likely (23%) to say they know how to reinvent themselves than low performers (8%).

“The shift to digital requires new technology, new approaches and, in many cases, entirely new roles for marketers,” said Ann Lewnes, chief marketing officer for Adobe. “The good news is that marketers see the change in front of them, and understand they need to embrace data, focus on creating personalized experiences and work across their social, Web and mobile channels. They just need to take the plunge.”

Data Seen As Important, But Not Always Utilized

A majority of marketers (76%) agreed they need to be more data-focused to succeed, but 49% report “trusting my gut” to guide decisions on where to invest their marketing budgets. Seventy-two percent of marketers agree their long-term success is tied to proving marketing return on investment.

Seventy-four percent of marketers say that capturing and applying data to inform and drive marketing activities is the new reality, and 69% agree on the need to embrace “hyper personalization” (i.e., using data to provide the right products, services and content at the right time). Yet only 39% of marketers report using consumer data and behavior patterns to shape marketing strategy in the past 12 months; 45% plan to use more consumer data and behavior in the next 12 months.

“CEOs expect their CMOs to be leaders in digital business innovation and growth, and no one has a better seat at the intersection of ‘digital’ and ‘customers’ than marketers. So marketers must act now to transform themselves and their organizations,” said Yvonne Genovese, managing vice president, Marketing Leaders Research, Gartner. “This starts with embracing the business of digital marketing and the technology that supports their business objectives. They also need to grasp the new data – all focused on customers and the results of digital marketing efforts. If they don’t, they risk seeing someone else step in to lead digital.”

Mobile, Multi-Channel and Personalization Becoming Bigger Priorities

Sixty-nine percent of marketers agree that mobile is a critical element to get right. In terms of media types and platforms, 61% of marketers see social media as the most critical area of focus 12 months from now, followed closely by mobile at 51%. Print (9%) and TV (7%) ranked last. Sixty-three percent of marketers said they were doing more social marketing compared to last year, and more than half said they were doing more direct customer engagement via e-mail (51%) and digital analytics (51%) than they were in 2013.

These priorities are driving a shift to more investment in digital talent within marketing organizations. Marketers cited digital/social marketer (47%), data analyst (38%), creative services (38%) and mobile marketer (36%) as key roles companies need to invest in over the next 12 months.

The survey also provides insight into what specific behavior marketers believe will make the biggest single difference in their effectiveness: the ability to work better across channels rose to the top (21%), followed by the ability to measure and learn from campaign effectiveness (16%).

When asked to prioritize one capability that will be most important to their company’s marketing moving forward, personalization ranked highest. Sixty-three percent of high-performing companies say that they are completely focused or very focused on personalizing experiences for customers, compared to 53% of average or low-performing companies.

About Digital Roadblock: Marketers Struggle to Reinvent Themselves

The data points referenced above come from a study commissioned by Adobe, produced by research firm Edelman Berland and conducted as an online survey among a total of 1,004 US marketers. Data was collected between Feb. 19-27, 2014 by ResearchNow. The margin of error at the 95% confidence level for the total sample is +/- 3.1%. Data was also broken out by the following sub-groups: Companies with (self-reported) low or average business performance (n=595) vs. companies with superior business performance (n=409). Companies with high digital spend, or where digital spend was >25% of total marketing budget (n=465), vs. companies with low digital spend, or where digital spend was <10% of total marketing budget (n=153).