Business News

Global print industry recovers from pandemic and shows resilience to new challenges

Thursday 18. August 2022 - The 8th drupa Global Trends Report will be published in September 2022. The first results of the survey conducted this spring are now available. One important conclusion is that overall confidence is rising and all regions and markets expect higher investment in 2023.

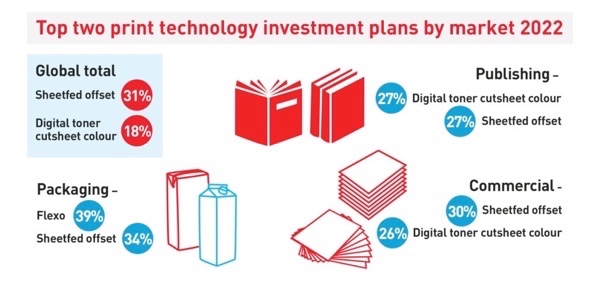

Top two print technology investment plans by market 2022

Compared to the last survey from 2019, which took place before the pandemic, the global industry is on average somewhat more confident about the future again. The packaging market is strong, as expected, but the commercial, publishing and functional printing markets also show signs of recovery for 2023. Regionally, confidence varies, with Asia and South America expecting better business in 2023, while Europe is more pessimistic given the war between Russia and Ukraine and its consequences.

Investment has inevitably declined over the past two years, but both print service providers and suppliers have expressed firm intentions for new capital expenditure. Sabine Geldermann, Project Director Print Technologies at Messe Düsseldorf, explains: “Print service providers, producers and suppliers are relying on innovation to be successful and internationally competitive in the long term. Although the challenges of recent years have led to a global decline in investment, the latest results show that the industry expects a recovery from 2023 onwards. All regions and markets are forecasting higher investment in the coming year.”

The results come from the online survey of the 8th drupa Global Trends Report, in which more than 500 decision-makers on the side of print service providers and machinery manufacturers/suppliers worldwide took part in spring 2022. The survey was conducted by commissioned partners Printfuture (UK) and Wissler & Partner (Switzerland) on behalf of drupa.

Confidence depends on market and region

Worldwide, 18% more print service providers rated their economic situation as “good” than those who said it was “poor”. Among mechanical engineers and suppliers the positive balance was even more pronounced at 32%. As always, the economic climate differs greatly in some regions and markets. The packaging market is flourishing, while publishing and commercial printing are confronted with structural changes due to digitalisation – but here, too, there are already signs of returning confidence. Regionally, the picture is mixed: Europe is clearly affected by the fallout from the Ukraine war, while other regions such as Asia and South/Central America expect business to pick up further in 2023 as post-pandemic economic momentum picks up.

Print volume and investment intentions

Analysis of print volume in 2022 by press type shows a continued decline in sheetfed offset among commercial printers, while packaging printers show growth. Flexo volume also continues to increase among packaging printers. All markets report an increase in volumes of cut-sheet digital toner colour printing, which, except for publishing, is also seen across markets in the use of digital inkjet roll colour printing.

Despite the demonstrable decline in sheetfed volumes in commercial printing, this was nevertheless the most popular press type for planned investment in 2023 across all markets – but with the exception of packaging, where flexo topped the list, followed by sheetfed. Digital inkjet colour printing was the second most popular investment for all other sectors. Finishing equipment was the second most popular investment after new presses.

Web-to-print

While the share of sales accounted for by web-to-print hardly increased between 2014 and 2019, it has risen sharply in the last two years for companies with such applications. For example, since 2019, revenue increased from 17% to 26% globally, and this sharp increase has been seen across all markets, albeit to varying degrees.

Socio-economic challenges and global economic situation

The impact of global socio-economic challenges varies by region. For example, 62% of printers in Asia cited pandemics as the biggest threat, compared to only 51% in Europe. And while 32% of European printers cited wars, this was only relevant to 6% of printers in South and Central America. Instead, 58% of respondents fear an economic recession far more. Richard Gray, operations director at Printfuture, explains, “Geopolitical impact is by far the biggest challenge for 59% of print providers and suppliers surveyed, and in some cases rated even more important than competitive pressures in the marketplace.”

The global economy has experienced more shocks in the last two years than at any time since the Second World War. Nevertheless, this survey shows that print remains a highly relevant means of communication in all markets and regions. Despite the current difficult environment, self-confidence and determination to successfully overcome these challenges prevail in the industry. With the help of smart strategic investments, the market participants will succeed.